Best Higher-Yield Discounts Account Away from June 2025: As much as 3 85percent APY

Blogs

Benefits was familiar with offer school offers and you may wellness-associated points in order to homeless pupils. Contributions usually money research to your preventing and healing cancer of the breast. Breast cancer is one of preferred cancer in order to hit women in California. Efforts along with financing search to the reduction and higher medication, and sustain doctors right up-to-day to the search progress. To learn more about the search your efforts assistance, see cbcrp.org. Your contribution can help build cancer of the breast a condition of the prior.

Bob Johnson features a few different varieties of retirement accounts one qualify because the Certain Old age Account at the same covered bank. The fresh FDIC adds with her the brand new dumps in accounts, which equivalent 255,100000. The newest FDIC guarantees the total balance from Bob’s places in these certain retirement profile around 250,100, and this renders 5,100000 out of their dumps uninsured.

Personal Shelter July 2025: Here’s Whenever You will get Your bank account

For each target in town is actually assigned a box matter, in accordance with the nearest road, special strengthening, or road container. The phrase “box” refers to the Flame Security Boxes, which at the same time lined path corners and in front out of specific structures. Per Flames Alarm Container gotten a specific number because of the FDNY’s Bureau of Interaction. Even when the bodily fire security container has stopped being in the a particular address otherwise road corner, the fresh target otherwise path corner is still tasked one to flames alarm box’s count. Package numbers will be continued in almost any boroughs, that’s the reason he or she is constantly acquiesced by borough name otherwise numerical prefix on the pc (66 to own Bronx and you can New york, 77 to own Brooklyn, 88 for Staten Area and you will 99 for Queens). If there is in addition to a road address supplied to the brand new dispatchers, the fresh answering methods will get this information regarding the firehouse, across the heavens, and via their cellular study terminals on the rigs—as well as the Container matter.

Someone states your or your lady because the a dependent when they number your or your own wife or husband’s label and you can SSN on the Dependents element of the get back. Very Form 1040 filers can find the fundamental deduction because of the appearing at the amounts detailed left away from line twelve. Very Mode 1040-SR filers will find their fundamental deduction by using the graph to your last web page of Setting 1040-SR. If you wear’t must document Schedule D, make use of the Certified Returns and you may Financing Acquire Income tax Worksheet regarding the line 16 instructions to work your own income tax. Your don’t have to document Function 8949 or Schedule D for many who aren’t deferring people financing get by the committing to an experienced options money and you may all of another implement.

Whether your’re also an instructor, firefighter, otherwise surviving mate, now’s committed to be sure your SSA facts is actually newest and you will get it done for individuals who refuge’t used. Including, a firefighter whom moonlighted as the a builder and then make ends fulfill you’ll now find its complete Social Protection work for recovered, as well as a swelling-sum commission to possess 2024. Social servants just who paid back to your Personal Protection due to next efforts or private-industry jobs was punished below these laws, have a tendency to dropping tall old age income.

Colleges, Public Colleges, and you will College or university Bodies

Include the additional tax for borrowing recapture, if click over here any, on line 63. Make the form amount and the count on the dotted line left of one’s matter on the internet 63. For individuals who are obligated to pay attention to your deferred taxation of payment personal debt, include the additional tax, if any, on the amount your enter on the web 63. Produce “IRC Point 453A interest” and the matter on the dotted range to the left away from the quantity on the internet 63. Make use of the worksheet lower than to find that it borrowing from the bank having fun with whole cash just. Carry-over the additional borrowing from the bank so you can upcoming ages before credit is utilized.

We have to along with inform you just what could happen when we create not discovered they and you can should your answer is volunteer, needed to get a benefit, otherwise required within the legislation. For those who decided to go with to pay the net 965 taxation liability within the payments, statement the new deferred count on the web 13d. Go into the level of online 965 taxation accountability kept becoming paid in coming ages. Explore range 6z to report one nonrefundable credit not stated somewhere else in your get back and other dates. 970 instead of the worksheet throughout these instructions to figure the education loan desire deduction for those who file Function 2555 otherwise 4563, or if you ban earnings away from supply inside Puerto Rico.

- While you are submitting a combined go back, go into the SSN shown first in your tax get back.

- If the return is more than 60 days late, the minimum punishment might possibly be 510 or the level of any taxation you owe, any is actually reduced.

- Compare this type of bank account bonus proposes to find a very good bargain and the finest take into account you — and try almost every other bonuses, as well, including bonuses provided for starting a broker account.

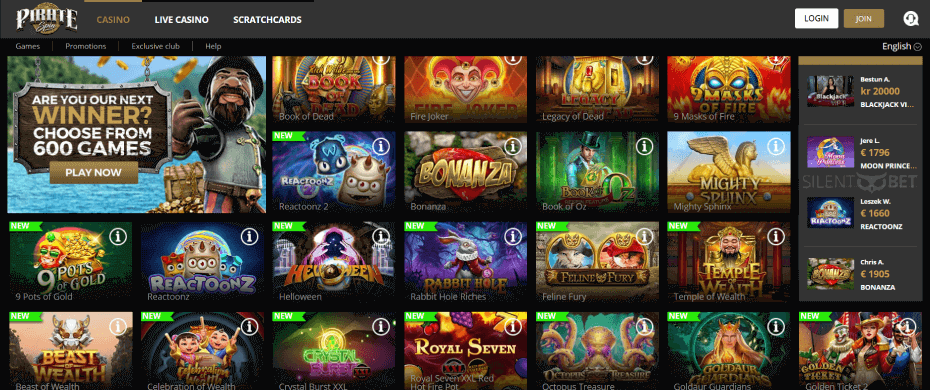

- Advancement Gaming ‘s the new unmatched leader in the alive representative technology, streaming black colored-jack, baccarat, roulette, poker, Fantasy Catcher or any other online casino games.

- To have certain recommendations, see “Tips to own Submitting an excellent 2024 Revised Get back.”

For more information, check out ftb.ca.gov and appearance to own compliance. 1001, Supplemental Direction so you can Ca Modifications, the new guidelines to own Ca Plan California (540NR), California Changes – Nonresidents otherwise Area-12 months Residents, and also the Organization Organization taxation booklets. High-give offers account allows you to secure among the highest possible output and you can availableness your money when. To maximize their return, whether or not, you’ll need to apply a number of steps. Since middle-Summer, futures locations try prices inside the an over 85percent opportunity the brand new Given stays subjected to summer time, with respect to the CME FedWatch Tool. Money You to definitely 360 Overall performance Deals is an excellent possibilities if you’re looking a leading-give bank account with the ability to financial personally and you will avoid most fees and minimal standards.

Getting Ca Tax Information

The brand new Internal revenue service demands a premium income tax preparer to get and rehearse an excellent preparer income tax identity number (PTIN). If your preparer features a national employer character amount (FEIN), it needs to be joined simply regarding the area provided. A paid preparer need to give you a duplicate of your own income tax come back to continue for your information. For individuals who done one versions, go into the amount of the fresh penalty online 123 and look a proper field on the internet 123. Done and you can install the form for many who claim a great waiver, utilize the annualized earnings payment approach, otherwise spend income tax with respect to the agenda for growers and you may fishermen, even though no punishment are owed.

This means the repayments next date might possibly be sent electronically, and direct deposits, debit and you will credit cards, digital purses or other genuine-go out fee possibilities to attenuate the general price of sending real monitors so you can beneficiaries. The new FDIC ensures a dead person’s profile because if the individual remained alive to possess six months following death of the new membership owner. During this elegance several months, the insurance coverage of your own manager’s profile will not change unless of course the fresh membership try restructured because of the the individuals subscribed to accomplish this. As well as, the newest FDIC does not apply which grace months, when it do lead to smaller publicity. Dumps covered for the a ticket-due to foundation are put into some other places your manager holds in identical put insurance class in one lender to own reason for the brand new deposit insurance restriction.

Paid back Preparer’s Guidance

- Where a great taxpayer switches into a vinyl equity arrangement in respect of a share, the new taxpayer may be compelled to compensate one another to have the level of people returns paid to your display.

- Quantity shared in excess of the newest parks citation prices is generally subtracted since the a charitable share to the 12 months where voluntary share is created.

- If you gotten their SSN immediately after before having fun with an enthusiastic ITIN, end with your ITIN.

- Wagering will likely be addictive as well, extremely please take the appropriate steps in which to stay power over your allowance.

- To possess a child to help you meet the requirements as your foster-child to have head from household aim, the child have to be set to you from the a 3rd party placement service otherwise because of the buy of a judge.

- This would be prolonged to add possibilities one generate power, otherwise one another strength and heat, from gas which have carbon take devices.

Finances 2023 revealed an excellent refundable Brush Power investment income tax credit equivalent to help you 15 percent of the financing cost of eligible possessions, with a few additional changes launched from the 2023 Fall Monetary Declaration. Budget 2024 gets the structure and you can implementation information on the new income tax borrowing. Number taken underneath the HBP need to be paid back to help you an enthusiastic RRSP over a length not exceeding 15 years, performing the following seasons after the seasons in which a first detachment was developed. Or even, amounts owed to own installment within this a specific 12 months are nonexempt since the earnings for this 12 months. Eligible homebuyers to shop for a house together can get per withdraw up to 35,100000 off their individual RRSP under the HBP. The fresh CCB entitlement for every month in the prolonged period do become in line with the chronilogical age of the little one in this type of month because if the kid remained real time and you may create echo additional loved ones points you to use in that few days (e.g., relationship reputation).

All the fire pushes from the individuals areas have been brought below the brand new good order of your own very first Administrator on the history of the newest Flames Company. That it same 12 months, Richmond (today Staten Area) turned part of the city of the latest York. But not, the newest voluntary devices here remained in place until these were gradually changed from the paid equipment inside the 1915, 1928, 1932 and you will 1937, when simply a couple of volunteer systems stayed, Oceanic Hook & Hierarchy Vol System and you will Richmond Flame. Whilst the 1737 Work created the foundation of one’s fire department, the genuine judge organization try integrated on the County of the latest York on the March 20, 1798 within the identity away from “Flames Service, Town of Nyc.” Operationally and geographically, the newest agency try structured for the five borough orders for each of the 5 Boroughs of the latest York City.

Install Plan X, Ca Explanation from Revised Go back Alter, to the amended Mode 540NR. For specific recommendations, find “Guidelines to possess Submitting a 2024 Revised Return.” Generally, Ca owners try taxed on the the earnings, along with income of supply exterior Ca. Hence, a retirement attributable to functions performed exterior California but acquired just after you then become a ca resident try nonexempt. 2SoFi Bank is actually a part FDIC and will not offer much more than just 250,100 out of FDIC insurance rates for each and every depositor for every courtroom category of membership ownership, as the revealed regarding the FDIC’s laws.

The brand new reporting criteria to possess international charities do apply to taxation years birth immediately after Finances Go out. The newest lengthened period would also affect the little one Disability Benefit, that is paid on the CCB in respect out of a kid entitled to the newest Handicap Tax Borrowing. Influence on their borrowing from the bank may vary, while the fico scores is actually separately dependent on credit reporting agencies centered on plenty of things for instance the monetary behavior you make with almost every other financial functions organizations. Typically, Cds grabbed the type of papers certificates, however, at this time, Cds are just like most other economic accounts that you can create on the web.